How Index Trends in Japan Reflect Economic Conditions

The Japanese economy has long been a focal point for investors worldwide, with its unique blend of technological innovation, global trade influence, and demographic challenges. For market participants, one of the most insightful ways to gauge the health and trajectory of Japan’s economy is by observing trends in its key stock indices.

Among these, the Nikkei Index stands out as a barometer of investor sentiment, corporate performance, and broader economic conditions. Understanding the forces behind its movements provides a window into the intricacies of Japan’s financial landscape and the factors shaping its economic future.

The Role of the Nikkei Index

The Nikkei Index, officially known as the Nikkei 225, represents the performance of 225 of Japan’s largest and most liquid publicly traded companies. It covers a wide spectrum of industries, from technology and automotive to finance and consumer goods, offering a comprehensive snapshot of the Japanese corporate sector. Movements in the Nikkei Index often mirror shifts in economic policy, global market conditions, and domestic consumer trends.

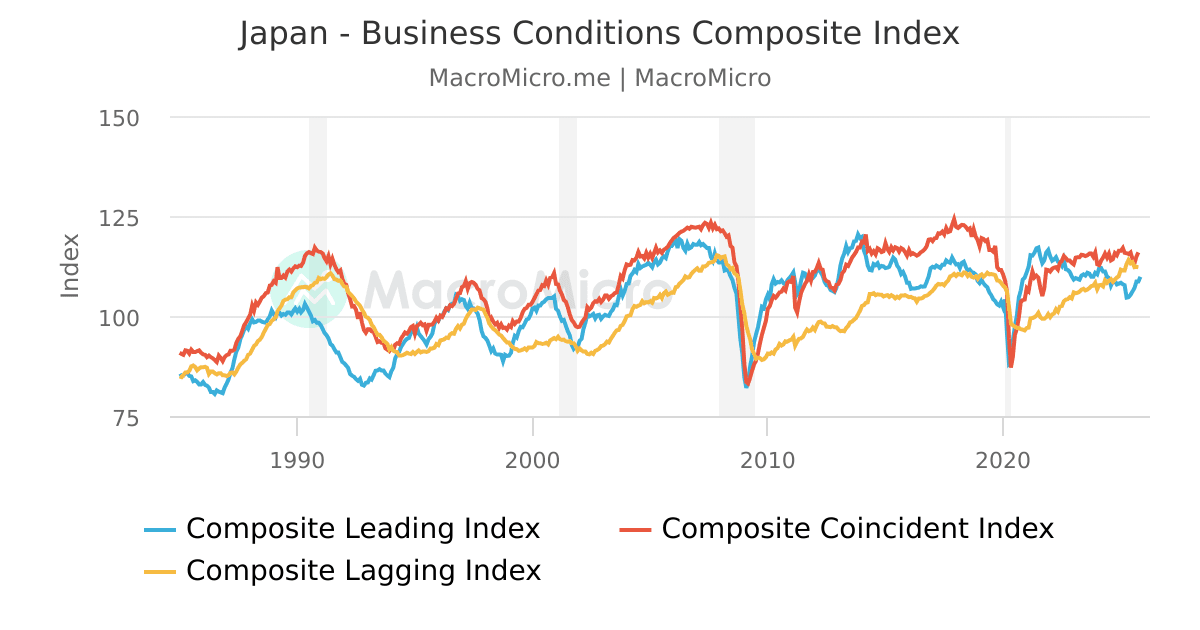

For investors and analysts alike, the index serves as both a leading and lagging indicator. Rising trends in the Nikkei typically reflect investor confidence, economic expansion, and strong corporate earnings, whereas prolonged declines can signal underlying weaknesses, whether from external shocks, internal economic stagnation, or structural challenges such as an ageing population and low birth rates. By closely monitoring the Nikkei Index, market participants can better understand Japan’s economic health and anticipate potential risks or opportunities.

Market Trends and Economic Signals

Japanese stock indices are sensitive to a range of economic signals. Monetary policy is one of the most influential factors affecting the Nikkei. The Bank of Japan’s stance on interest rates and quantitative easing directly impacts investor sentiment, as lower borrowing costs can stimulate corporate investment and consumer spending, supporting stock price growth. Conversely, any tightening of policy or unexpected shifts in inflation targets can create volatility in the index, reflecting concerns over potential economic slowdown.

Global trade conditions also play a pivotal role. Japan’s economy is heavily export-oriented, with sectors such as automotive, electronics, and machinery reliant on demand from overseas markets. Shifts in global trade flows, currency fluctuations, and geopolitical tensions can significantly influence corporate earnings, which in turn affect the Nikkei Index. For example, a strengthening yen can reduce the competitiveness of Japanese exports, pressuring stock prices, while a weaker yen tends to support export-driven companies and lift the index.

Domestic consumption patterns further contribute to index trends. Japan’s consumer market, shaped by changing demographics and lifestyle trends, drives the performance of retail, technology, and service sectors. Strong consumer spending can boost corporate profits, signalling economic resilience, whereas subdued consumption may indicate broader economic challenges, particularly in the context of an ageing population and evolving labour dynamics.

Sectoral Shifts and Their Implications

A closer look at the Nikkei Index reveals that sectoral performance often provides early clues about the direction of the broader economy. Technology and industrial sectors, which have historically been major contributors to Japan’s GDP growth, tend to lead during periods of innovation-driven expansion. Rising stock prices in these sectors may reflect increased investment in research and development, global demand for Japanese technology, or breakthroughs in manufacturing efficiency.

On the other hand, fluctuations in the financial sector can offer insight into domestic credit conditions and interest rate expectations. Banks, insurance companies, and other financial institutions respond to both monetary policy and macroeconomic stability, making their performance a useful gauge for overall economic confidence. Similarly, consumer-oriented sectors, including retail and services, are closely tied to employment trends and household income levels, offering a window into the health of domestic demand.

Global Influences on Japanese Indices

Japan’s economy does not exist in isolation, and the Nikkei Index often reflects the interplay between domestic and international developments. Global market sentiment, trade relationships, and foreign investment flows can amplify or dampen movements in Japanese indices. For instance, periods of global economic uncertainty may lead to capital flight from equities, causing index declines, while positive developments abroad, such as technological partnerships or trade agreements, can buoy investor confidence in Japan.

Currency fluctuations are another critical factor. The Japanese yen’s value against major currencies such as the US dollar affects export competitiveness, profit margins, and corporate valuations. A weakening yen generally supports stock prices for export-heavy companies, while a strengthening yen can suppress earnings and weigh on the index. Investors often monitor these dynamics closely, as they provide insights into potential market reactions to international events.

Conclusion: Reading Japan’s Economic Pulse Through Its Indices

The Nikkei Index is more than just a measure of stock market performance—it is a dynamic reflection of Japan’s economic conditions, policy environment, and global integration. By tracking its trends, investors and analysts can gauge the interplay of domestic demand, corporate health, monetary policy, and international influences, gaining a nuanced understanding of the country’s economic trajectory.

For those interested in exploring Japanese market trends in depth, monitoring the Nikkei Index provides a valuable lens through which to interpret economic signals and anticipate shifts in market sentiment. The insights drawn from these indices are indispensable for making informed investment decisions and appreciating the complex factors shaping Japan’s economic landscape.